English

English

German

German

Since the ECB has been continuously lowering its key interest rate, the pressure on lending margins and therefore on the earnings of banks and savings banks has increased.

The BGH ruling on the consent solution in September 2021 has also made it more difficult to increase commission income.

Find out how structured price management can help banks to increase their earnings and strengthen their competitive position.

Setting prices poses significant difficulties for many decision-makers. This is often due to limited capacities, a lack of technical or methodological understanding and the need to meet urgent regulatory requirements, such as the implementation of EBA guidelines. In such cases, pricing takes a back seat, leaving important potential untapped.

It’s a well-known fact: the economic environment for German banks has deteriorated dramatically over the past decade. Low interest rates are squeezing the profit margin, and despite the expansion of lending business, higher net commission income and reduced material and personnel costs, the institutions are earning significantly less money today than they did twenty years ago.

One solution to this problem lies in systematic price management, because price is still a greater lever for improving profitability than many other measures.

Our current analyses, projects and publications show that considerable increases in earnings can be achieved through systematic price optimization. Our project for a medium-sized regional bank, only one of many successful examples, proved that a potential of over two million euros per two billion euros of balance sheet total per year became real.

For optimal results, we carry out a thorough analysis of your pricing potential. We focus on areas such as current accounts and the house bank model to exploit cross-selling opportunities. We identify opportunities to increase sales, for example by uncovering unintended special conditions, and consider aspects that are currently particularly important, such as customer deposits.

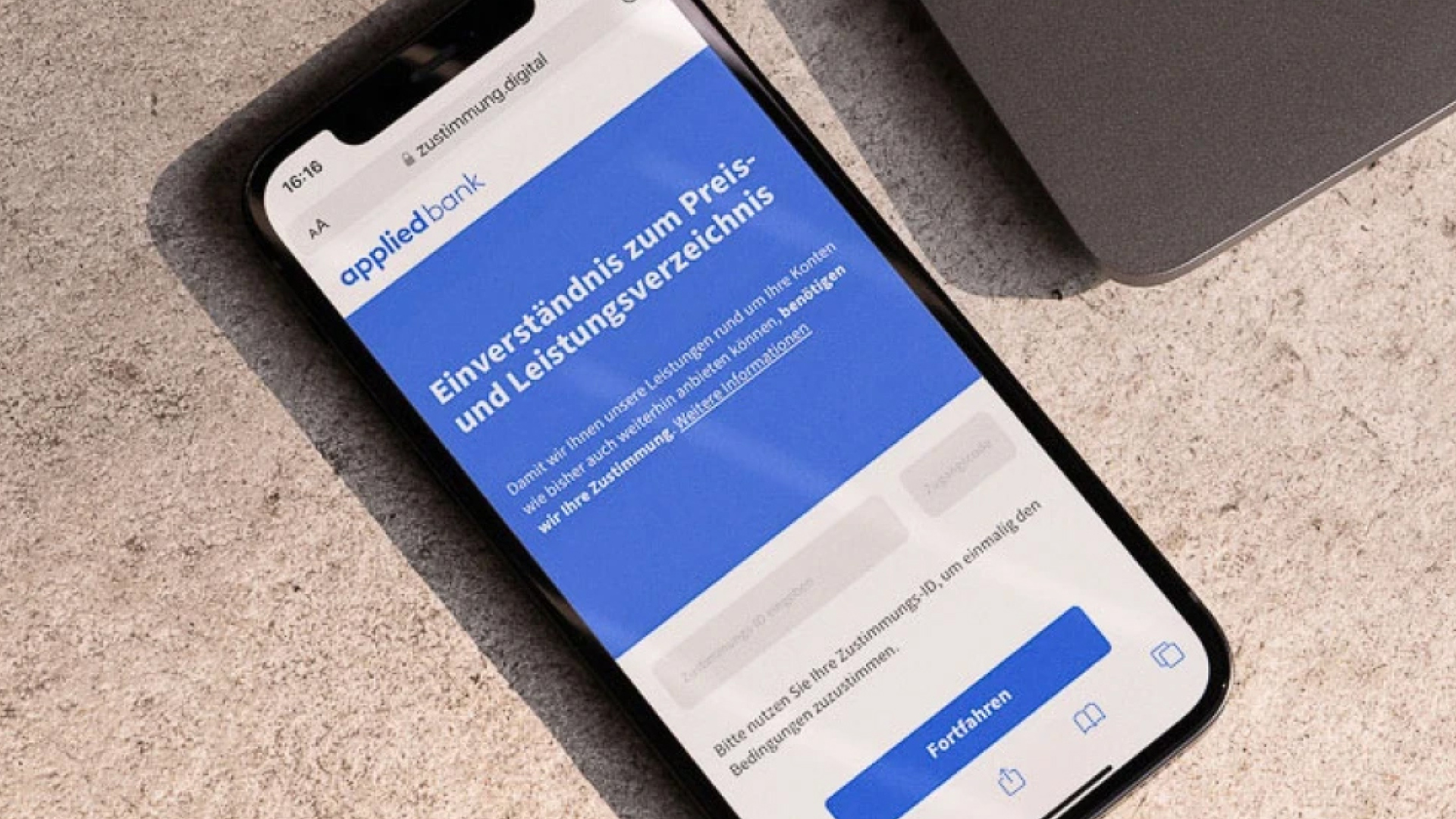

Are you looking for a digital solution for the house bank model or for customer consents? Our digital subsidiary zeb.applied has exactly what you need. Use our software in your individual design and achieve accelerated digitalization success in your pricing topics.

Smartes Kredit-Pricing für Finanzdienstleister

Der zeb-Kredit-Pricing-Ansatz verbindet externes Benchmarking mit einem smarten Pricing-Konzept, das kundenindividuelle Preisbereitschaften für die Optimierung Ihres Zinsergebnisses ermittelt.

Giro-Pricing für Finanzdienstleister

Viele Finanzdienstleister fragen sich derzeit, wie sich Erträge aus privaten und geschäftlichen Giromodellen nachhaltig steigern lassen. Wie das geht, zeigt der markterprobte zeb.Giropricing-Ansatz.