Where do you see the main challenges for banks when it comes to ESG?

Werner Konezny: Since January 1, 2023, banks have to apply the EU taxonomy to new business, determine an ESG score – similar to a credit score – for each of their customers, and report the Green Asset Ratio (GAR) in their disclosures for the first time at the end of the year. These comprehensive regulations require banks to interpret thousands of pages of documentation and implement them in their systems and processes.

Sven Krämer: The review and collection of these ESG-relevant records and especially data must be integrated into existing processes to ensure that they meet three essential requirements: Firstly, it must be as simple and intelligible as possible for both customer and customer advisor. Secondly, the increased requirements need to be managed efficiently. And thirdly, the topic of ESG must be seen as an opportunity in advisory services – from the ESG potential analysis per industry and customer to the corresponding ESG support. This way, advisors and customers work together to find future-proof solutions.

What does zeb offer in terms of simple and efficient solutions?

Werner Konezny: Our experience shows that mapping the requirements individually per topic, i.e. taxonomy, scoring and carbon accounting (GAR), is complicated for both bank staff and end customers. Therefore, when implementing the topics in our zeb.ESG Suite software solution, we made sure to map ESG requirements in an integrated way.

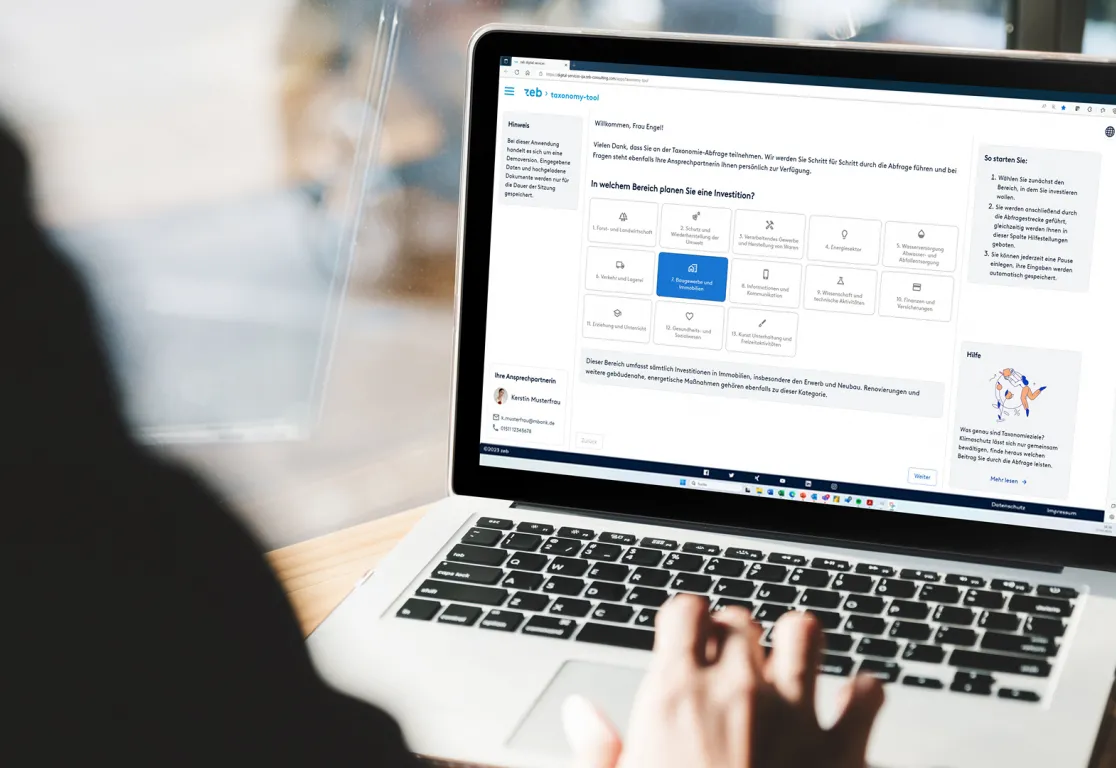

In terms of the simplicity of the solution, we paid particular attention to clearly structured decision trees and questions. Understandable language as well as help and explanatory texts on the core topics make the entire web application user-friendly and accessible.

Sven Krämer: To ensure the efficiency of the solution, we consistently simplified individual question areas by means of succinct summaries, incorporated country-specific simplifications and integrated external public data sources. By reusing disclosures and data from the title of the ESG taxonomy, scoring or carbon accounting, information is bundled in one central location.

The opportunity in advisory services that you mentioned earlier, where does it arise in your view?

Sven Krämer: The call for increased sustainability is aimed at every company, and it is coming from multiple directions: Our environment is changing and forcing adjustments. The markets are responding. And finally, society is also increasingly demanding new priorities. If a reduction in greenhouse gases by approx. 55% is to be achieved by 2030, huge climate-relevant investments are required across all economic sectors. The EU Commission assumes a direct financing volume of approx. EUR 1,000 billion per annum in Europe alone – as a conservative estimate. For banks, this could lead to additional earnings of nearly EUR 15 billion per year, or approx. EUR 110 billion by 2030, according to estimates from our “European Banking Study”.

Werner Konezny: Thus, we need to focus on the transition business, i.e. supporting companies on their way to a significantly lower carbon footprint or an improved ESG profile. The segment accounts for a large part of the overall market, but is still neglected by many banks, although we believe this is the key area for earnings-focused banking. With the Wallet Model in our zeb.ESG Suite, we help our clients to identify this potential, determine it per industry and allocate it to their customers. This is flanked by a realignment of the advisory process as well as the associated interview guidelines and after-sales checklists.

From your perspective, how will ESG topics be integrated into the processes in the future?

Werner Konezny: We generally assume that the topics in the context of taxonomy, ESG scoring and carbon accounting will have to be integrated into the advisory process and will be part of the customer advisor’s daily routine. When developing our software, we made sure that customers and banks can jointly work on ESG-relevant questions and data. We want to enable both customers and their advisors to collaborate on the topic and collect all ESG-relevant data in one central place. To do so, banks need a flexible solution that can be integrated into different areas of the IT architecture. It also needs to support the key advisory processes for the corporate, SME and/or retail segments for end customers. To meet these requirements, we have developed our software based on an open API approach. It can also be used as a stand-alone solution.

You can find out more about the EU taxonomy and the zeb.ESG Suite software solution on our Digital Services Hub.